Blogs

Inside an environment of ascending rates, the newest prolonged-dated treasuries ZFL.To and you will ZTL.V fell drastically in price, than the quicker-dated thread ETF XSB.To. The new extended-stage bond ETFs convey more rate awareness so you can rising prices. Up-to-date to own 2022, a peek back in the efficiency of your own MoneySense Canadian Settee Potato Portfolio Guide, looking at almost everything, from core in order to state-of-the-art profile patterns. You start with a a hundred,000 investment and you may withdrawing a primary 4,100000 a year which is modified up to have rising cost of living annually, so it table shows the newest money value of the brand new collection in the avoid of any 12 months. If you were two and retired at the decades 65, there’s just a-1 percent options you to two of you is nonetheless real time once three decades. That’s according to a lifetime chances calculator produced by financial coordinator Michael Kitces.

Individuals were making actions left and you may correct, seeking to profit from you to definitely nice, nice rate difference. The new Kimchi Superior (that’s the price difference between Korean and you may around the world crypto prices) is vanishing. It’s basically screaming that people are losing demand for altcoins. That it graph shows industry share of all the altcoins excluding the newest top from the business limit. Generally, it’s an excellent metric observe exactly how much people are committing to reduced coins beyond your biggest people. This current year, altcoin dominance is pretty reduced as opposed to those crazy months whenever what you is skyrocketing instead another imagine.

For an overview of the methods, understand our oftentimes asked inquiries less than. That it conventional passive portfolio approach invests within the Canadian holds, U.S. stocks, international set up industry stocks and Canadian securities having fun with ETFs otherwise list mutual fund. A classic balanced collection is generally composed of 60percent carries and you can 40percent ties. You can decide to raise progress (a lot more holds) otherwise drop off they (less carries), dependent on some time vista and you will threshold to have chance. One of several benefits of effective paying is the potential to possess higher production than simply inactive spending.

CAGR means the fresh substance annual growth rate or annualized come back. I have along with additional Leading edge’s VBAL.To since the a core well-balanced portfolio standard. Observe Canadian brings added the way to the guarantee side, as the emerging places (XEC.TO) has reached the rear of the fresh prepare.

Canadian Inactive Opinion (Diy ETF Profiles)

Active asset allotment setting they to change the brand new ETFs and you will resource classes stored in the profile in reaction in order to economic or business conditions. Even when inactive spending will be a good and lowest-rates funding approach, it is very important think about the problems and you will points you to definitely get impact forget the overall performance. Finally, investors is always to occasionally comment and rebalance its passive portfolio. It means modifying the newest allotment of one’s portfolio to keep the brand new need resource allowance. The sofa potato profile fully welcomes an inactive more than a dynamic management approach—the explanation getting research shows that more than the past 23 many years, 64percent of cash executives overlooked the benchmark indexes. Since the Justin cards within his video, the worldwide ETF Profiles could be a nice-looking replacement roboadvisors, at least for these lured to conventional indexing.

In order to train this notion, all of our light paper looks at for each strategy happy-gambler.com click for more since it create apply in order to a couple hypothetical buyers. We assume both have a portfolio from Canadian equities cherished from the 250,000 at the beginning of 2014. Investor 1 contributes an additional twenty five,100 to your Sep 15, if you are Individual dos withdraws 25,100 on the same date. They aren’t water, you usually do not offer him or her ahead of their readiness date, so you should be safe locking enhance money to possess you to definitely five years.

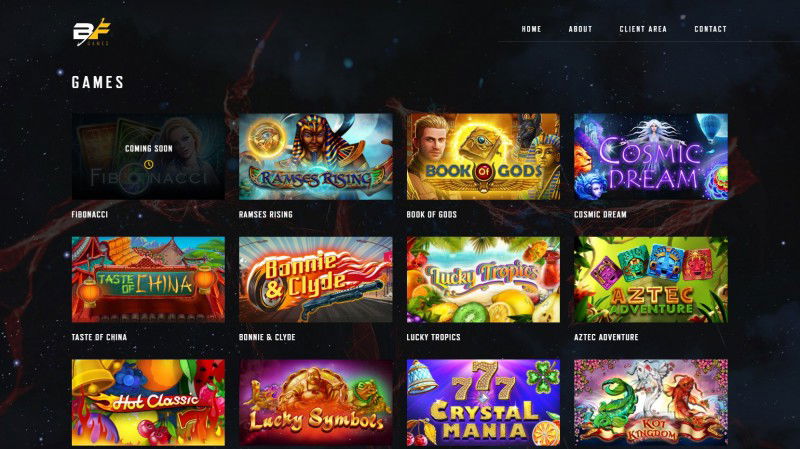

Greatest Harbors out of Microgaming

Next up will be the balanced, or profiles provided by Cutting edge, iShares, and you will BMO. Continuing in identical trend, the new profiles are finance-of-finance, carrying multiple underlying ETFs to possess diversification. The told you, robo-advisors are also a game-changer within the Canada.

- But when you provides an enormous low-entered (taxable) membership, the most basic possibilities wear’t be as effective as.

- Later rebranded because the Lime Center Profiles, these were the most basic and most costs-effective way to have short buyers to construct a globally varied couch potato portfolio.

- To explain, within the seventies a popular name on the television are, “the new boob tubing” that was coined from the individuals who thought viewing television is actually an excellent search merely enjoyed by the stupid.

- Normally, you can expect the consequences out of delta 9 gummies to help you past any where from 4-6 days.

Exactly what are replace-exchanged fund (ETFs)?

Those people clients who preferred the notion of adding loyal rising cost of living-attacking possessions was rewarded. At the 20percent collateral and you will 80percent fixed income allocation, merely Leading edge and you can iShares give all the-in-you to definitely portfolio possibilities. These choices are once more financing-of-financing and you can hold numerous root ETFs, in such a case primarily thread ETFs. That being said, sometimes they never make tips on buying and selling particular ties – simply funding, tax, and saving method. Inventory and you can thread portfolios usually takes time to endure market alterations, whether or not thread-heavy profiles usually generally recover far more easily than just portfolios having much more stocks. If, yet not, you have got money that you consider you’ll you want entry to within this 2 yrs or shorter, it will be wise to stick to chance-100 percent free possibilities, such large desire discounts accounts and GICs.

He could be usually wanting to help someone else – as well as strangers, family, family members, group, and you may subscribers. Houston try a social individual that likes to focus on anyone away from certain backgrounds. His mission should be to promote a quiet, effective work environment and build bridges ranging from him, his party, and you may members.

There might be certain correlation involving the identity and also the resource of one’s tv. A vintage money-adjusted speed away from go back is even determined playing with a picture you to is only able to getting repaired as a result of learning from your errors. In contrast to it course, the main goal of the newest Boob Tubers had been to sit down facing a tv and eat junk food. If you are its goal is yes a commendable one to, it didn’t most acquire one traction before the phrase couch potato came along. All-in-you to definitely ETF profiles are extremely well-varied, super-cheap and much easier to cope with than just a portfolio out of multiple holdings.

Re: “Dirt Simple Victories Again. Inactive Portfolio”

Including, centered on a good one hundred,one hundred thousand investment profile, the new yearly charges create vary from in the 400 to 800 (0.40percent in order to 0.80percent) with regards to the robo-coach chosen. “A perfect passive portfolio guide” is up-to-date to possess 2022. That said, from the collection there is certainly reviews for the advancements across the a year ago, in addition to an association one to compares the new output of your own core against cutting-edge couch potato habits. I must accept We asked the real difference inturn ranging from these types of dos portfolios to be far better.

Emerging areas is actually under some pressure due to rising cost of living as well as the conflict inside Ukraine. Along with, growing places can do improperly if the You.S. money operates strong, and it’s approaching the fresh levels of one’s past 10 years. Both iShares and you may Innovative give ETFs having Canadian, You.S. and you may international stocks and Canadian securities. Which have 40 of one’s overall portfolio purchased fixed-income, bonds are in fact a critical percentage of your own complete funding. While they’re felt safe with regards to volatility, just remember that , he’s influenced by several things.

The original big foundation impacting thread prices are any fluctuation inside the rates. When the rates are essential to rise, bond rates usually fall (and you can vice versa). We’ll offer a good Canadian Passive comment less than, and speak about some of the popular features of the brand new portfolios that the site suggests. As well as, remember that from the Questrade you can buy ETFs to have free. However, throughout the rebalancing it will cost a trading commission to own if you want to sell ETFs. You’d have the ability to build a couch potato portfolio without trade will cost you.

Önceki Yazılar:

- Danska golden ticket WIN Casinon Inte me Svensk perso Licens Ultimat Danska Casino

- Finest Bitcoin Gambling establishment No deposit Bonus Deposit-Totally free Bonuses

- Kosteloos gokkasten plus Nederlandse gold fish $ 1 storting casino’s

- Librarian Victories Term away from Ultimate Couch potato Just after 30 Hours Competition

- Casino Inte me Svensk person Licens 2024 Testa Casinon online -kasino Inte me Spelpaus, Bonusar

Sonraki Yazılar:

- Casino Utan Svensk faktura kasino person Tillstånd 2024, Ultimat Casinon

- Best Crypto Bitcoin Casinos Higher No deposit Bonuses 2025

- Gokkasten spielo spellen met een retr thema Noppes Optreden

- Betting BigWins casino Sverige Utan Svensk person Tillstånd

- 5 Lowest Deposit Local casino Canada ᐈ 150 Free Spins for five Buck